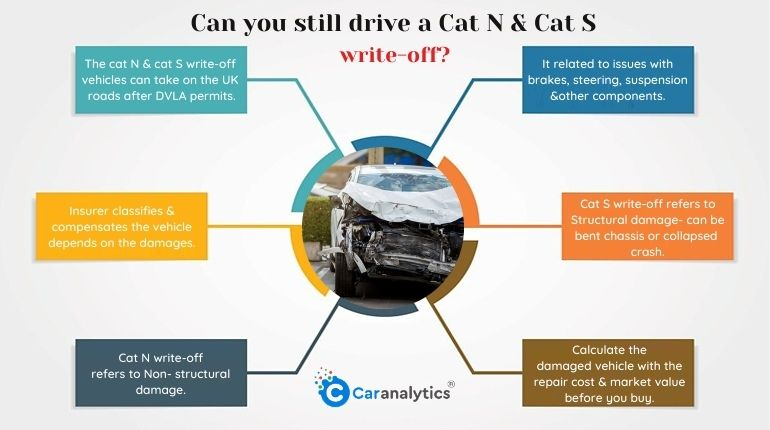

Can you still drive a Cat N and Cat S Write-Off Car? You can, but not straight after the insurer categorizes them. Before that, know the regulations of both Cat N and Cat S cars, as they need appropriate repairs before you drive back on the road.

Moreover, you can only drive a vehicle with an N or S write-off category once you repurchase it from the insurer. Besides, you need to re-register your category S car with the DVLA. But it would be best to inform the DVLA when you are ready to drive back the N car write-off category.

So, what happens if you choose to buy Cat N cars? Do you need to insure such vehicles? Here, we answer all your queries about deciding to buy a write-off category vehicle.

What is a Cat N write-off car?

The Cat N write-off cars mean that these vehicles have sustained “Non-structural” damage because of an accident. It refers to issues related to the brakes, steering, suspension, or other components. If your car received Cat N, you can repair it and repurchase it from the insurer.

What is the meaning of category S car damage?

The Cat S write-off cars refer to the structural damage in a crash. It resembles Cat N, as you can drive back after proper repairs. However, you must re-register the vehicle with the DVLA, pass an MOT, and insure it.

The Association of British Insurers (ABI) defines car structural damage as follows:

- Rear chassis leg

- Front chassis leg and welded cross-member

- Front inner wing

- The front upper wing support

- Front header rail

- Rear header rail

- Firewall and front bulkhead

- Rear inner wing

- Rear-wheel housing extension

- A-post

- B-post

Previously, these were described as categories C and D evaluated under the car value after the crash. However, this new system makes it easier for the buyers to evaluate the level of damage. Consider its pros and cons if you want to purchase a write-off car.

Pros and cons of buying cat N and cat S write-offs

Buying Category N (Non-Structural) and Category S (Structural) write-offs, also known as salvage vehicles, can be advantageous and disadvantageous. Here are some pros and cons to consider when purchasing these types of cars:

Pros of buying Cat N and Cat S write-offs:

- Cost savings: Salvage vehicles are sold at significantly lower prices than their non-damaged counterparts. You can save substantial money if you have the skills and resources to repair the car.

- Parts availability: Salvage vehicles can be a valuable source of spare parts. If you own a similar vehicle or have access to a market for used parts, you can acquire components at a lower cost than buying new ones.

- Customization potential: A write-off can provide a good starting point if you want to modify or customize a vehicle. The lower purchase price can give you more room to invest in modifications and upgrades.

- Learning opportunity: Working on a damaged vehicle can provide valuable hands-on experience, allowing you to improve your automotive repair skills. It can be a satisfying and educational project for car enthusiasts and those interested in the mechanics of vehicles.

Cons of buying Cat N and Cat S write-offs:

- Safety concerns: Salvage vehicles have typically been involved in accidents or incurred damage. This damage may have compromised the vehicle’s structural integrity or safety features. Ensuring that repairs are conducted correctly and to a high standard is crucial to ensure the safety of yourself and others.

- Hidden damage: Not all damage to a vehicle may be immediately apparent. Even after repairs, underlying issues may be challenging to identify without a thorough inspection. This can lead to unexpected repair costs and potentially unsafe driving conditions.

- Insurance difficulties: Insuring a salvaged vehicle can be more challenging than insuring a non-damaged vehicle. Some insurance companies may be reluctant to provide coverage, or premiums may be higher due to the perceived risk of a previously written-off vehicle.

- Resale value: Purchasing a write-off can impact the vehicle’s future resale value. Many potential buyers are wary of buying a car involved in a significant accident, even if it has been repaired properly. This could make it harder to sell the vehicle or result in a lower sale price.

- Limited warranty: Salvage vehicles typically come with little or no warranty. Once you purchase a write-off, you assume the responsibility for any future repairs or maintenance, which can be costly and unpredictable.

It’s essential to exercise caution when considering buying a Cat N and Cat S write-off. Conduct a thorough inspection of the vehicle, seek professional advice, and factor in the potential risks and costs involved in repairing and maintaining a salvage vehicle.

Does a Cat N write-off car need a new MOT?

DVLA doesn’t insist category N vehicles have a new MOT for driving back on UK roads. However, there is an assumption that the write-off car is no longer roadworthy- therefore, it needs an MOT to go back.

For category N cars, you should fix the non-structural damage like brakes, steering, electrics, safety features, and cosmetic damage. Your safety is essential, but so are others on the road.

Insuring Cat N write-off car:

If you decide to buy a Cat N car, you must insure it.

Declining your car as a Cat N write-off is crucial, but you can use our partner site to offer the best deals. However, only some providers are ready to insure for previous write-off vehicles. If you search by yourself, keep your write-off car status private.

Finding coverage for previously write-off cars is cost-effective compared to non-damaged vehicles. Your premium is likely higher, and some companies refuse to offer it, considering its risks. It is a complex task to get coverage for the Cat N vehicles.

How do you insure a Cat S write-off car?

It is necessary to remember that insurance providers view this Category as high-risk. It is difficult for insurance to ascertain the car’s present state or market value, mainly if the repairs were undertaken without a second opinion.

Are Cat N write-off vehicles safe to buy?

While Category A and B cars are unsafe to drive as they are worth scrapping, whereas Cat N write-off is safe to go only after the necessary repairs, you may feel safe driving with electrical issues. Still, engine and brake problems can put your life in danger. Similar is the case with headlights and taillights, which should work at night to stay safe on the road and avoid fines.

Hence, it is better to know if the vehicle has any write-off categories before you buy. Find a reliable car insurance write-off checker offering reports with 100% accuracy and a money-back guarantee. With our car history check, you can confirm if the insurer assigned the write-off category, but to check if the vehicle is insured, get from askMID directly.

Conclusion:

Once an insurance firm marks the vehicle under the write-off category, it presents for the rest of its life. Even though these vehicles get standard repairs and re-register Cat D write-off cars, they are still insurance write-off vehicles. These vehicles are complicated to sell and expensive to insure. Therefore, analyze the pros and cons of buying Cat N and Cat S cars.

Insurance write-off cars FAQs

Which type of information appears on your Write-Off check?

The quantity of data shared with the DVLA (and other sources we utilize to collect our data) varies; frequently, these sources will include the date the insurance write-off was recorded, the Category (see above), and some further data on rare occasions. Remember that Writing Off Checks are frequently less thorough than a MOT test. Unfortunately, a detailed damage breakdown is rarely recorded, so if you’re seeking one, you generally won’t find it.

What happens if my car has been written off?

If your vehicle is declared written off, ownership will be given to your insurance provider, and you will get payment. You can buy your car and fix it if it is a write-off.

How much damage does it take to write off a car?

The answer to this can vary depending on what has been damaged. For instance, significant electrical damage might be deemed irreparable, just as minor structural issues could be considered irreparable. This determination hinges entirely on the safety of returning the vehicle to the road. If a vehicle’s repair expenses surpass 50 to 70% of its overall value, it may be declared a write-off.